Gravestone Doji: How to Spot and Trade The "Death Doji" Candlestick Pattern

The Gravestone Doji is a bearish candlestick pattern that signals the end of the current trend. It’s also known as “Death Doji” because it resembles a gravestone, and often marks an extended decline in price following a long uptrend.

This article will answer common questions about Gravestone Dojis and how to trade them, including:

- What does the Gravestone Doji look like?

- How do you spot one?

- When should I expect one to form?

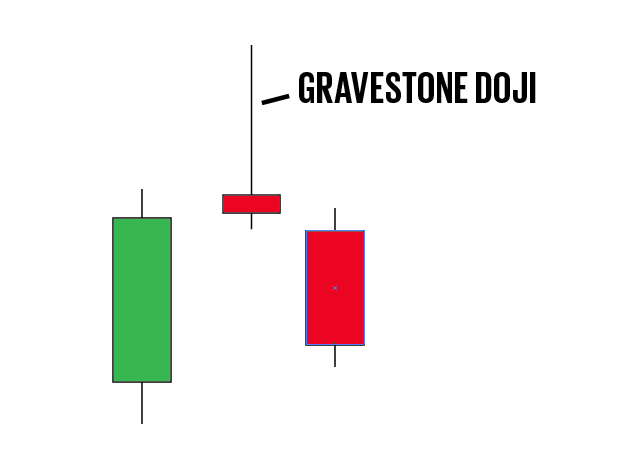

What is a Gravestone Doji Gravestone Doji

Gravestones are a variation on the more common long-legged doji and look like gravestones in candlestick charts. They’re composed of only one candle with no upper or lower shadow, which looks exactly like an “empty” space when viewed from left to right.

The Gravestone is formed when the open and close price for a given time period during an uptrend are equal (or very near each other). The Gravestone forms after there has been significant movement up in price over several trading sessions because it signals that buyers have exhausted themselves, marking the end of this particular move higher.

When traders see Gravestones form at market tops they tend to sell their positions immediately rather than wait out what could be another extended downtrend. Gravestones will form on all time frames and can be found in both daily, weekly and even intraday charts.

How to Spot a Gravestone Doji?

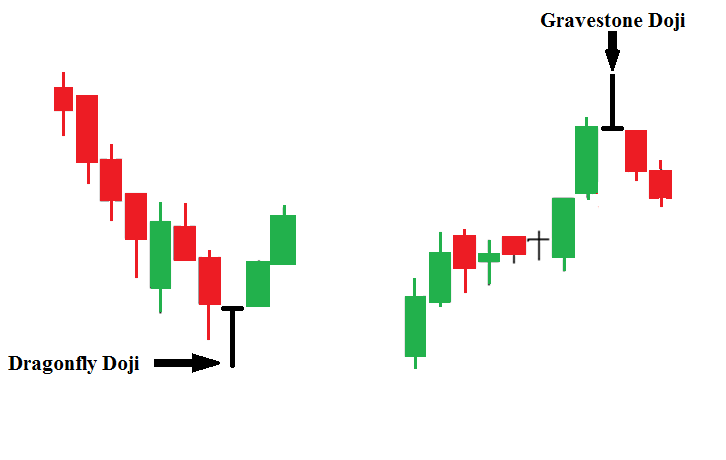

The Gravestone looks just like any other doji candle except for its size; it’s much bigger than traditional dojis such as Spinning Tops and Dragonfly Dojis . This means Gravestone candles will have longer wicks coming out of both sides (if they closed near their highs). They may also not appear very frequently on the chart which makes them more significant when they do form.

The Gravestone forms after buyers (bulls) have been in control of the market for some time and is often a warning sign that they’ve become exhausted (or perhaps even over-extended).

The Gravestone Doji can either be found at major tops or near strong support levels, though it’s more common to see them form at top. The Gravestone tells traders that selling pressures (bears) are beginning to take hold which suggests that an extended downtrend could follow, especially if there’s no subsequent bounce higher off this level.

Just like with any other doji formation we recommend waiting until after the Gravestone has formed before taking action; don’t jump ahead and assume you know where the price will go based on its appearance alone!

How do you trade a gravestone doji?

Gravestone Doji Gravestone Dojis are often used to predict the end of a long uptrend, which means it’s usually wise to sell into this candlestick pattern if you’re currently holding onto any long positions.

If you already have an existing short position then Gravestones can be great confirmation since they tell us that selling pressure is increasing and moving against the current trend (which was previously up).

You should always wait for confirmation on your Gravestone doji before putting on your trade; in fact, we recommend waiting until there has been some follow through lower using another technical indicator or charting pattern. This will give traders more confidence when taking their entry because price action won’t immediately reverse after triggering!

- For example: If Gravestone Dojis are forming near a major support level then you could wait for price to close below this zone before opening your position. You don’t need Gravestones to start trading though, even if they’re one of the most popular candlestick patterns!

- For example: If Gravestones only form once every few weeks it’s probably not worth waiting around until they do show up because there will be plenty of opportunities in between where we can get good entries using other strategies.

Can gravestone doji be bullish?

Gravestone Dojis are formed after a significant uptrend so they’re often bearish patterns. Gravestones can be found at market tops which tells us that buying pressure has become exhausted and the trend is likely to reverse lower.

This doesn’t mean Gravestone doji have no bullish implications though – Gravestones can also form near strong support levels where price might find some temporary demand before continuing its downtrend (for example, if there’s an important psychological level nearby like $50 or it marks a major Fibonacci retracement zone).

Like all candlestick formations, Gravestone dojoi should only be traded on confirmation of the pattern; wait for prices to close below this area before opening your position!

Difference between gravestone doji and shooting star?

Gravestone Dojis are larger than traditional doji patterns which means Gravestones will have longer wicks coming out of both sides (if they closed near their highs). They may also not appear very frequently on the chart which makes them more significant when they do form.

Shooting Star Gravestone Dojis can either be found at major tops or near strong support levels, though it’s more common to see them form at top. A Gravestone tells traders that selling pressures (bears) are beginning to take hold which suggests that an extended downtrend could follow, especially if there’s no subsequent bounce higher off this level.

Wrapping Up Gravestone Dojis

Gravestone Dojis are perfect for trading if you’re looking to take advantage of an extended downtrend. Gravestones can be bullish too, but only when they form near strong support levels or important Fibonacci retracement zones. Gravestones also usually indicate that the uptrend has come to a close which means it may be time to sell your long positions before prices start heading even lower!